Welcome to Insider Cannabis, our weekly newsletter where we’re bringing you an inside look at the deals, trends, and personalities driving the multibillion-dollar global cannabis boom.

Sign up here to get it in your inbox every week.

Happy Friday readers,

This week’s volatility was brought to you by the WallStreetBets forum on Reddit. As “meme stocks” like Gamestop and AMC fell back to Earth, the forum’s users turned to a new target: cannabis stocks.

The trading frenzy saw shares of Canadian cannabis companies like Sundial and Tilray surge on Wednesday, and slump on Thursday.

We've got you covered on the implications of all this - and where you should be putting your money instead.

Beyond that, we have a look at how hedge funds with significant investments in cannabis weathered the crash of 2019, and profited in 2020. One fund, JW Asset Management, ended the year up a whopping 146%. You can read that story here.

Yeji took a dive into the emerging psychedelics space, breaking down the top players, their business models, and when to expect their medications to hit the market.

-Jeremy (@jfberke) and Yeji (@jesse_yeji)

Here's what we wrote about this week:

What to know about the major public psychedelics companies, including a guide to their business models and when they expect to sell medications

A year ago, there were just a handful of publicly traded psychedelics companies.

Today, the landscape looks drastically different as psychedelics companies have made the jump into public markets, seeking more capital to develop drugs for regulatory approval, build out networks of clinics, or cultivate and extract psilocybin from mushrooms.

Insider identified the biggest companies in the industry, most of which have gone public within the past year. Here's what to know about them, including a guide to their business models and when they expect to sell medications

Reddit traders are piling into cannabis stocks and driving up valuations, but experts say they're betting on the wrong companies

The traders who hang out on the Reddit forum WallStreetBets have a new target as GameStop shares fall back to Earth: cannabis.

But investors say those looking to bet on US legalization are looking in the wrong place: They should be investing in US companies directly.

Three hedge funds that focus on cannabis generated eye-popping returns by betting on the US, according to exclusive documents

Three hedge funds that have significant holdings in the cannabis industry, including dedicated cannabis funds, shared returns exclusively with Insider. The documents show that after steep losses in 2019, investors who held on were rewarded as the industry recovered.

JW Asset Management led the pack, gaining a whopping 146% in 2020.

Here are the cannabis stocks that experts say you should bet on now

The biggest cannabis stocks had a wild week. They got slammed on Thursday, after soaring on Wednesday, in part thanks to retail traders spurred by Reddit forum WallStreetBets.

Insider talked to analysts who said that the stocks that are currently experiencing volatile trading aren't the right companies to bet on. Instead, they said, look to US MSOs.

Executive Moves

- HEXO Corp announced that it has appointed Charles Bowman as General Manager of its US operations.

- Former Clever Leaves Global Head of B2B José María Forero will be joining Blueberries Medical Corp. as President of Latin American Operations. He will start his role next Tuesday.

- Travel writer and cannabis activist Rick Steves has been named chair of the National Organization for the Reform of Marijuana Laws (NORML) board.

- Cannabis PR firm Mattio Communications is launching Confluence, an influencer marketing agency. Victoria Baek will serve as CEO. Mattio also appointed Nicole Walsh as its first chief culture officer.

Deals, launches, and IPOs

- US cannabis company Green Thumb Industries said it raised $100 million from a single, unnamed institutional investor. The company filed an S-1 to prep for a US listing when federally permissible earlier in February.

- A group of cannabis companies and organizations, including startups like Eaze and publicly traded companies like Canopy Growth, launched the US Cannabis Council. The organization says it will push to end federal cannabis prohibition in the US as well as advance social equity and racial justice in the industry.

- CBD brand Beam closed a $5 million Series A led by C2 Ventures and Yard Ventures, among other investors.

- Cannabis tech startup Green Check Verified raised a $2.4 million convertible note, led by Flatiron Venture Partners, among other investors.

- Embattled cannabis retailer MedMen has retained the investment bank Moelis & Co to explore "strategic alternatives."

Policy moves

- Former HHS Secretary Kathleen Sebelius joined the National Cannabis Roundtable as co-chair. Sebelius, also the former Democratic governor of Kansas, will be heading the industry group alongside former Republican House Speaker John Boehner. Read more here from Politico.

- Wisconsin Gov. Tony Evers unveiled a plan this week to legalize marijuana through the state budget, reports Marijuana Moment.

- Marlboro-maker Altria registered to lobby on cannabis legalization in its home state of Virginia, where lawmakers passed legalization bills last week. Altria has a significant stake in Canadian cannabis company Cronos Group.

Earnings Roundup

- Canopy Growth reported Q3 earnings on Tuesday, reporting C$152.5 million revenue and an C$829 million loss. CEO David Klein said on a call with investors that he expects Canopy to enter the US market later this year and said that he predicts the company will turn a profit by 2022.

- Aurora Cannabis reported its Q2 earnings on Thursday, reporting C$67.7 million in revenue and an adjusted EBITDA losses of C$16.8 million.

- cbdMD reported its Q1 earnings on Tuesday, reporting $12.3 million in net sales and a $9.4 million loss.

- Canopy Rivers reported its Q3 earnings on Wednesday, reporting net income of C$1.4 million. The company said its revenue increase was driven by its investment in US cannabis company TerrAscend.

- MedMen and Green Thumb Industries are scheduled to announce earnings next week.

Science and research

- Cannabis is associated with a reduction in blood pressure among older adults, according to a new study published in the European Journal of Internal Medicine.

Chart of the week

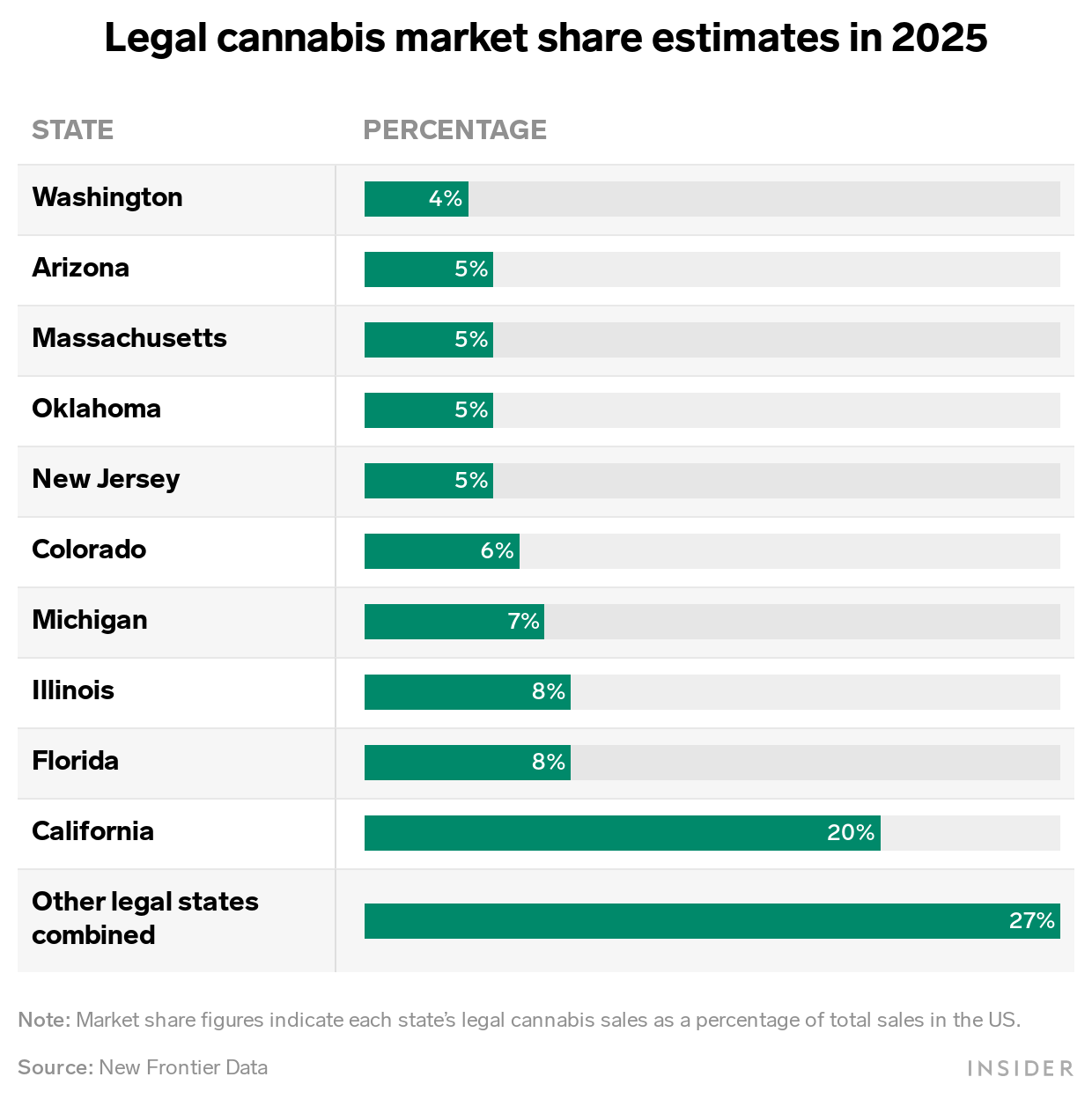

The largest cannabis markets in the US will be California, Illinois, Florida, Michigan, and Colorado, by 2025 according to data from New Frontier Data. The data assumes no additional states pass legalization measures and there are no significant federal policy changes:

What we're reading

How Tobacco Giant Altria Is Becoming A Cannabis Company (Forbes)

The Half-Legal Cannabis Trap (Politico)

Can a Company Patent the Basic Components of Psychedelic Therapy? (VICE)